Using TrendSpider for Futures Market Analysis

Discover how TrendSpider can revolutionize your futures trading with automated analysis, smart alert...

Gold options trading can be a surprisingly practical way to shield your portfolio from the sneaky sting of inflation.

Inflation tends to reduce the purchasing power of money. This means that traditional investments like bonds and cash often fall short when you consider the real picture. Stocks are not exempt either because rising costs can eat into profit margins, making things tough for companies. At the same time, fixed-income assets usually offer low returns that barely keep up with inflation or may not keep up at all.

If you have ever dipped a toe into the world of investing, you know gold tends to sparkle a bit brighter than most. But when it comes to gold options trading, things get a tad more interesting. This guide will walk you through the essentials without drowning you in jargon perfect for anyone looking to add a little shine to their portfolio without losing sleep over complex details.

Gold options are financial derivatives that give you the right but not the obligation to buy or sell gold at a set price within a specific timeframe. These contracts let investors try to guess gold price moves or protect themselves from unexpected swings. They provide clear risk boundaries and flexibility.

Gold options differ from physical gold, ETFs or futures because they cap your risk to just the premium you pay and still let you cash in on price swings whether up or down.

Visual representation of gold options trading concepts and terminology with gold bars and financial charts

Gold has long been considered a trusty old friend when inflation starts acting up, thanks to its intrinsic value and a track record that rarely wavers. Trading gold options lets investors tap into this reliability, cranking up the protective perks while keeping a tighter leash on possible losses.

Options give investors a neat way to crank up leverage and control bigger positions without needing a mountain of cash upfront. Best of all, the downside is capped to just the premium paid which offers some peace of mind.

Take a good hard look at how inflation risks could impact you and figure out what slice of your portfolio you would feel comfortable shielding with gold options.

Find a reliable brokerage platform that handles gold options trading without high fees and executes your trades smoothly—Binance is a solid pick or any other exchange that offers futures.

Brush up on option pricing, especially how premiums change due to volatility, time decay, and trends in the gold market.

Decide whether buying call or put options makes more sense for you based on how you think gold prices will behave amid inflation.

Pick strike prices and expiration dates that match your inflation protection timeline and your comfort with risk—tailor it to your own pace.

Place your trade but keep a hawk’s eye on the gold market and big economic indicators since they can throw curveballs.

Stay ready to tweak your positions when necessary, whether locking in profits or cutting losses to manage your downside risk.

Nailing the right strike price and expiration date is key to getting the most value from gold options. Take a strike price just above the current gold price—what we call slightly out-of-the-money. It usually has a cheaper premium but requires a noticeable price jump to see profits. On the flip side, longer expiration dates give inflation more time to affect gold prices but tend to carry higher premiums because of the extra time.

Common mistakes often boil down to spending too much on options without truly weighing their premium value. People cling to them until expiration without a solid exit strategy and sometimes tune out subtle market whispers hinting at shifting inflation trends.

Managing risk well is absolutely key when trading gold options—it's all about safeguarding your capital while chasing those gains.

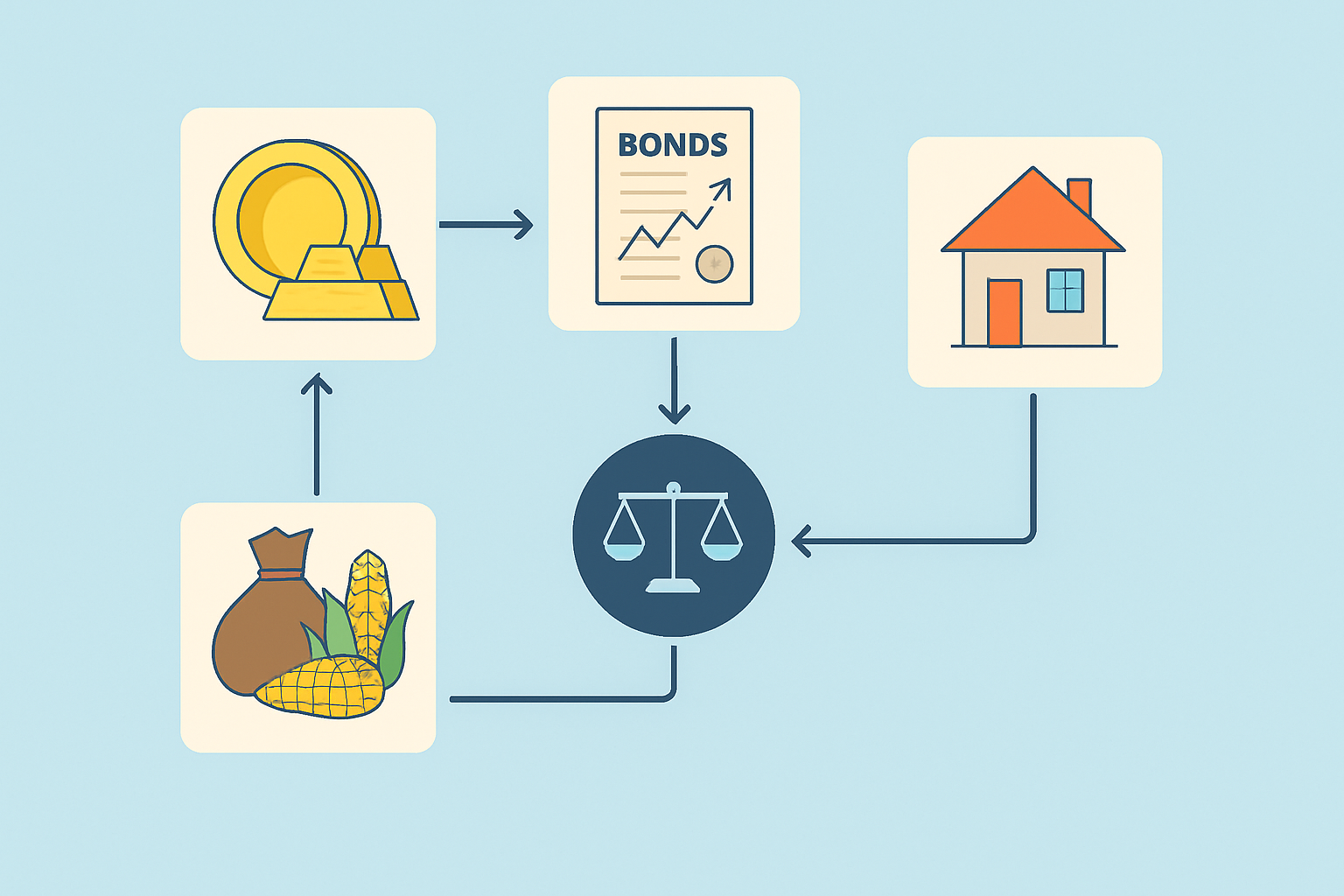

Including gold options in a broader inflation protection plan usually means rounding out your portfolio with assets like inflation-protected bonds or real estate or commodities.

Visual schema of a diversified inflation protection strategy combining gold options with other asset classes

Reliable trading platforms like Binance really open the door to gold options trading, thanks to their user-friendly interfaces and fairly reasonable fees—perfect whether you’re just starting out or have been around the block a few times. When it comes to diving into chart analysis and fine-tuning your strategies, tools such as TradingView and TrendSpider offer a treasure trove of advanced technical features and live data that can really steer you in the right direction.

Struggling to improve your trading performance? Edgewonk's advanced analytics tools are designed to give you the edge you need.

With detailed trade journaling, robust strategy analysis, and psychological insights, you'll gain a comprehensive understanding of your strengths and weaknesses. Don't miss out on this game-changing opportunity.

Traders, it's time to elevate your game. Edgewonk is the ultimate trading journal software designed to empower you with data-driven insights and personalized strategies. Take control of your trading journey and maximize your potential.

16 articles published

Driven by a passion for democratizing financial markets, Vivienne creates educational content on forex trading and currency market fundamentals for beginners.

Read Posts

Discover how TrendSpider can revolutionize your futures trading with automated analysis, smart alert...

Explore the best brokers integrating with TradingView that offer free demo accounts for futures trad...

Master trading with Bollinger Bands by understanding volatility, setup patterns, and risk management...

Learn how the True Range indicator captures market volatility and price swings, empowering traders t...